Indonesia is a country with enormous economic potential, which has not gone unnoticed by the international community. Indonesia's largest economy in Southeast Asia possesses various qualities that position the country well for advanced economic development. Furthermore, the central government has recently expressed significant support for reducing Indonesia's traditional reliance on (raw) commodity exports and increasing the importance of the manufacturing industry in the economy. Infrastructure development is also a top priority for the administration, and it should have a positive impact on the economy. I believe more foreign investment from the entire world, improving the nation's infrastructure, and ending corruption are vital requirements to grow Indonesia's economy. This article will share my opinion and views on how my country, Indonesia, can prosper much further. Moreover, I will explain why I have so much respect for my current president, Jokowi Widodo.

Ticker Banner

Monday, February 14, 2022

How My Country, Indonesia Can Prosper & Improve Much Further

Indonesia is a country with enormous economic potential, which has not gone unnoticed by the international community. Indonesia's largest economy in Southeast Asia possesses various qualities that position the country well for advanced economic development. Furthermore, the central government has recently expressed significant support for reducing Indonesia's traditional reliance on (raw) commodity exports and increasing the importance of the manufacturing industry in the economy. Infrastructure development is also a top priority for the administration, and it should have a positive impact on the economy. I believe more foreign investment from the entire world, improving the nation's infrastructure, and ending corruption are vital requirements to grow Indonesia's economy. This article will share my opinion and views on how my country, Indonesia, can prosper much further. Moreover, I will explain why I have so much respect for my current president, Jokowi Widodo.

Saturday, February 5, 2022

My View on Relationship, Family, & Wealth

The reason why the relationship fell apart was that I was not strong enough mentally and financially. I was still depending on my parents, and I was confused about my own identity. I was traumatized from my first relationship, which resulted in me being very picky when it comes to choosing the partner in my life. I don't want to make the same mistake again. Going through a breakup is really harsh; it almost made me go insane.

I met a lot of girls after my breakup; however, I never had chemistry with them. I am always looking for the one to be my soul mate. Furthermore, I was very strict with my personal finance, making it harder to make the spark. It is a turn-off when you are frugal towards someone you like. I know readers who had been following my blog understand my ambition to be financially independent. However, readers would probably understand more after finishing reading this article. In this blog post, I'm going to talk about the reason why I'm still single. Moreover, I will talk about my secret crush and why I am so obsessed with becoming financially independent.

Tuesday, January 25, 2022

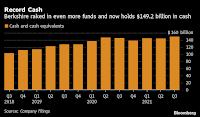

Warren Buffett’s Cash Pile Tops Record with $149.2 Billion on Hand

Why Professional Fund Managers Often Underperform the S&P 500 & the Best Alternative Solution

This is not exactly breaking news to many investors. Moreover, thanks to the likes of Warren Buffett and Jack Bogle promoting the benefits of investing in less expensive, passively managed index funds, S&P estimates that there are $11.2 trillion in S&P 500 index funds. To be fair, many active fund managers are not simply seeking to outperform the S&P 500; they're also trying to provide investors with risk exposures that aren't replicated by the benchmark index.

This is an exciting topic to talk about. I wondered if it's better to let a professional fund manager manage my portfolio or whether it's better to manage my own. When I came back from the United States to Jakarta, Indonesia, My father did give me some capital to start with. I invested some of the money into Mutual Funds managed by professionals. The result is not very exciting; the portfolio that fund managers manage did worse than the stock portfolio I built from scratch. In this article, I will explain whether it is better to invest on your own or pay a fund manager to do the job for you. Moreover, I will explain my experience as a stock investor and why you should just invest in a low-cost index fund such as S&P500 (Ticker: SPY) if you are still a beginner in the investing world.

Monday, January 17, 2022

Why Saving Rate is the Most Important Factor to Building Wealth

Friday, January 7, 2022

My Idol, Charlie Munger, boosts Alibaba's stake, purchases another 300K shares

This is exciting news to talk about. One of my idol investors, Charlie Munger, raised its holding by 99.3% to 602,060 sponsored American Depository Shares of Alibaba Group (Ticker: BABA) as of December 2021. He bought an additional 300,000 shares. It seems he is a huge fan of Alibaba. In this article, I will talk about his investment move when many investors are fleeing the scene. Moreover, I'm going to give my opinion on his investment purchase on Alibaba Group. As you readers know, I am heavily invested in Alibaba and planning to keep my position despite my loss.

Monday, January 3, 2022

Why I'm Going to Keep Holding Alibaba Stock

From my average cost, my Alibaba position has an unrealized loss of 44% (January 2022) which is approximately $315,000 of my capital. However, I'm not discouraged about my investment and keep holding my shares for a long-term play. I'm going to keep purchasing more Alibaba shares with the dividends I will receive from Pfizer Inc. (Ticker: PFE) and my rental income.

Yes, it's true that if I had stuck with my previous portfolio, my stock portfolio would have $1,350,000. That's approximately $350,000 difference. I learned my lesson that sometimes it's better to be diversified. Luckily, I'm not using options that have an expiry date for holding a particular stock. So even if my stock portfolio is doing poorly at the moment, I know I still can make money in the long run. In this article, I will explain why I'm going to keep holding to my Alibaba stock and why I think the fallen price is an excellent opportunity to purchase more shares of Alibaba stock.

Monday, December 27, 2021

New Year 2022 Resolution (My Personal Plan & Goal for the Year)

Moreover, I could stick to my financial plan, such as saving and investing every month. Another thing I accomplished in 2021 is learning how to use Word Press Engine for building websites, and I can make all kinds of websites by myself without needing to hire a web developer to build a website.

The Covid Pandemic crisis problem is still not finished yet, but I see the progress of people getting vaccinated. I hope this issue can resolve in 2022. 2022 will be a new year for me, and I will be 32 years old soon. This actually scares me because I'm not getting any younger, and I still want to achieve many things in my life. I want to share my new goal and plan for this fresh start to the year in this blog post.

Thursday, November 18, 2021

The Power of Dividends

My portfolio used to consist of dividend-paying stocks; however, I had decided to use concentrated play like investing the majority of my portfolio is in Alibaba Group (Ticker: BABA). In a way, I regretted making this investment adjustment to my portfolio since my previous version portfolio is doing much better than the current one. I like my previous portfolio much more because I could receive dividends from holding those stocks in my portfolio. With the dividends payout, I was able to buy more shares of companies that I like. Well, there is nothing I can do about it now since most of my capital is invested in only two stocks, Alibaba Group (Ticker: BABA) and Pfizer Inc. (Ticker: PFE).

Due to my mistake, I learn something valuable, which is not to underestimate dividend-paying stocks. In this blog post, I am going to explain the power of dividends. Moreover, I will explain why holding a portfolio of dividend-paying stocks can be an excellent stock investment strategy. Lastly, I am going to give my opinion on investing in dividend-paying stocks.

Saturday, November 13, 2021

Why I'm Planning to Stay with My Parents Even If I'm Married

Back then, I used to want to own my own home because I liked the design of my house to be minimalist. I was always complaining about how my older brother got the opportunity to live on his own. I felt he was lucky to live on his own, but now I feel fortunate I’m able to live with my parents. I’m glad that my dad prevented me from purchasing my own place. If it wasn’t for him, I would probably be in financial trouble now. As I grew up, I learned many valuable lessons from my parents that made me think differently. This is the reason why I want to live with my parents even if I’m married. I hope my future wife can agree to my idea. In this article, I will explain my reasoning as to why I will live with them forever. Moreover, I’m going to talk about my plan of building my own dream home.

Monday, November 8, 2021

Why Paying Taxes is Crucial to the Economy, and Why the Wealthy Should Pay More on Taxes

Warren Buffett, who is my mentor and someone I admire, believes the government should tax the wealthy more. Warren Buffett believes that the wealthy in America do not pay enough taxes. "The wealthy are undertaxed relative to the general population," he told CNBC's Becky Quick "Squawk Box." In this article, I will bring up the topic to the fundamental understanding behind taxation. Then I will explain why it is crucial to tax more of the rich people. Moreover, I will also explain the cons to this idea. In the end, I will talk about my opinion about taxing more of the wealthy.

Sunday, October 31, 2021

Why Has China Become the Wealthy Country It is today

We look back on how the People's Republic of China's transition spread the extraordinary wealth - and entrenched inequality - throughout the Asian giant as the country commemorates its foundation anniversary.

"China was extremely, very poor when the Communist Party took control," says DBS China economist Chris Leung.

"They relied on self-sufficiency because they had no

trading partners or diplomatic contacts."

Since 1980, China

has experienced a significant poverty reduction. The national poverty rate

declined from about 90% in 1981 to under 4% in 2016, according to the World

Bank's $1.90 per day poverty level (in 2011 prices at purchasing power parity),

meaning 800 million fewer people living in poverty.

China has implemented a series of historic market reforms to open up trade routes, and investment flows during the last 40 years, lifting hundreds of millions of people out of poverty. This is a fascinating topic to write about because I am heavily invested in Alibaba (Ticker: BABA), a Chinese company. Because of this reason, I researched why and how China became the wealthy nation it is today. This article will explain the history of poverty in China and how it has become one of the leading nations it is today. Moreover, I will explain what progress China has developed and why I want to learn Mandarin again.

Tuesday, October 19, 2021

Charlie Munger’s Firm Doubled Down on Its Alibaba Investment

I am holding Alibaba stock (Ticker: BABA) as the majority of my portfolio. I own 3285 shares of Alibaba at an average cost of $215.45. I am still down about 18% from my average purchase cost. However, I am still confident in this company because it is an excellent value growth stock. Because I am holding Alibaba stock, I am curious why Charlie Munger doubled down on Alibaba stock. This article is going to focus on information about Charlie Munger's recent double-down purchase on Alibaba. Moreover, I am going to mention the bull and bear scenario in investing in this company.

My New Bedroom Workstation - 'The Famous Table'

The table I have set up uses the classical theme design. Personally, I prefer minimalist design more. However, because my parents' house is a classical design, I have to match it with that theme. Also, this table compares the theme of my other furniture in my bedroom. All of the furniture in my bedroom looks uniform and matches each other. I have been waiting for this workstation for a very long time due to Covid-19 Pandemic. However, I was finally able to persuade my parents to make one.

I know this topic is not related to investment or personal finance, but because this is the work setup that I will use to build my career life and my journey to financial freedom, I will talk about it. After all, this workstation is called "The Famous Table" for a reason. This article will share all the equipment and gadgets that I use to set up my workstation. I hope this can be an inspiration for readers interested in setting up a workstation.